chaspikfest.ru Gainers & Losers

Gainers & Losers

Is It Too Late To Get My Dog Vaccinated

The vaccinations your puppy receives at eight and ten weeks protects against viruses like Canine Parvovirus, Parainfluenza and Canine Distemper, as well as. For example, a puppy would receive the rabies vaccine at 16 weeks, 1 year and then again at age 4. Are There Optional Dog Vaccines? Although puppy vaccines and. Missing a vaccination or booster If your puppy or kitten is more than 2 weeks late for booster vaccination, their immune system will no longer be as active. 10 days after their 10 week vaccination you can then take your puppy out in public areas. What do you need to vaccinate against? Parvovirus – a highly. It is recommended that puppies should be immunised from 6 weeks of age, weeks apart, with a second dose from 10 weeks of age. The onset of immunity is one. Usually, puppies between the ages of 6-and 8 weeks get the first dose of this vaccine. In just another three weeks, vets recommend the booster shot to continue. It depends on where they are in the schedule. We recommend puppies get a booster vaccine three weeks later, especially if it's a leptospirosis vaccine and they'. Your vet will create a new vaccination schedule to make up for missed or late doses. Just bear in mind that your puppy will not be protected against disease. Generally speaking, puppies should get their first rabies shot around 16 weeks of age and again between years old. The rabies vaccine is mandatory. The vaccinations your puppy receives at eight and ten weeks protects against viruses like Canine Parvovirus, Parainfluenza and Canine Distemper, as well as. For example, a puppy would receive the rabies vaccine at 16 weeks, 1 year and then again at age 4. Are There Optional Dog Vaccines? Although puppy vaccines and. Missing a vaccination or booster If your puppy or kitten is more than 2 weeks late for booster vaccination, their immune system will no longer be as active. 10 days after their 10 week vaccination you can then take your puppy out in public areas. What do you need to vaccinate against? Parvovirus – a highly. It is recommended that puppies should be immunised from 6 weeks of age, weeks apart, with a second dose from 10 weeks of age. The onset of immunity is one. Usually, puppies between the ages of 6-and 8 weeks get the first dose of this vaccine. In just another three weeks, vets recommend the booster shot to continue. It depends on where they are in the schedule. We recommend puppies get a booster vaccine three weeks later, especially if it's a leptospirosis vaccine and they'. Your vet will create a new vaccination schedule to make up for missed or late doses. Just bear in mind that your puppy will not be protected against disease. Generally speaking, puppies should get their first rabies shot around 16 weeks of age and again between years old. The rabies vaccine is mandatory.

Generally speaking, puppies should get their first rabies shot around 16 weeks of age and again between years old. The rabies vaccine is mandatory. Many states, boarding facilities, day cares and groomers require up–to–date vaccinations. A facility that does not require cat or dog vaccinations may be an. Once your puppy reaches adulthood, and all of the core puppy vaccines have been administered, your veterinarian can begin implementing an adult dog vaccination. If a specific antibody titer is low, your dog will require a booster vaccine. Currently, vaccination against a single disease may not be available, and it is. Dogs or cats can be considered overdue for revaccination with core vaccines if the last dose was administered over 3 years ago. With the exception of the 1-year. Puppies should typically receive their first shots as soon as they are weaned or around 8 weeks old. Your puppy should then continue those shots roughly every. Many states, boarding facilities, day cares and groomers require up–to–date vaccinations. A facility that does not require cat or dog vaccinations may be an. However new research by several vaccine manufacturers has led to the approval of vaccines good for 3 years in adult dogs that have received all puppy vaccines. Dogs at high risk for Lyme disease include those living outside or those who frequent environments that harbor ticks. If you live in or frequent areas that have. Afterward, boosters are recommended every three years. If your adult dog hasn't been vaccinated yet, or is overdue or missing some vaccinations, it's not too. Is it too late to vaccinate my dog? No, it's never too late to vaccinate your dog. Talk to your vet about what vaccinations your dog needs. Is it illegal to. Dogs at high risk for Lyme disease include those living outside or those who frequent environments that harbor ticks. If you live in or frequent areas that have. If your puppy stops receiving vaccines too early in this program or misses a vaccine, it can reduce their body's ability to fight off the infection. Failure. Puppies can receive their parvo vaccinations at 6, 8 and 12 weeks of age. They must receive a full series of vaccinations to ensure complete immunity. Puppies. If your dog has had the starter course, and is late on the first booster, there is a window of up to 6 months (off license) to bring the vaccination up to date. Vaccinate your domestic dog, cat, or ferret (and be sure to keep the Once a person develops rabies symptoms it is too late to vaccinate against rabies! For example, if your dog had its first vaccine at 8 weeks and then there was no proof of a vaccine after 8 weeks and your puppy is now 15 weeks, the vet will. If the dog has a fever, the immune system will be so "occupied" with the fever that it will respond poorly to the vaccine. It is important to discuss any health. Once your puppy reaches adulthood, and all of the core puppy vaccines have been administered, your veterinarian can begin implementing an adult dog vaccination.

Fha Loan After Short Sale

Homebuyers can qualify for FHA Loan three years from the date of their short sale. FHA expects no late payments after a short sale and re-established credit. Short Sale on FHA loans Just got a call from a pre-forclosure that has an FHA loan with Countrywide/BoA. Said the property is in great condition, just needs a. They appraise it based on both existing condition and value after improvements. It's a 3% down payment mortgage but they're are a number of. Yes. If you had the bankruptcy 4 years ago or more then you'd qualify for a conventional loan. If not, you can qualify for FHA or VA loan after. After Short Sale/Deed-in-Lieu of Foreclosure · Fannie Mae (conventional) loan – 4 years · FHA loan – 3 years · VA loan – 2 years · USDA loan – 3 years. It's vital to keep paying your mortgage until the short sale closes. If you were current, you could qualify for a Federal Housing Administration (FHA) mortgage. If the borrower does not qualify for any of the FHA Home Retention Options and the property sales value is not enough to pay the loan in full, the servicer may. **Short Sales due to relocation and/ or job transfer, that had no late Mortgage Payments prior to date of move may be eligible sooner than 3 yrs (sometimes. If you have experienced a bankruptcy, foreclosure, or short sale, these are the waiting periods before you can obtain a traditional home loan. Homebuyers can qualify for FHA Loan three years from the date of their short sale. FHA expects no late payments after a short sale and re-established credit. Short Sale on FHA loans Just got a call from a pre-forclosure that has an FHA loan with Countrywide/BoA. Said the property is in great condition, just needs a. They appraise it based on both existing condition and value after improvements. It's a 3% down payment mortgage but they're are a number of. Yes. If you had the bankruptcy 4 years ago or more then you'd qualify for a conventional loan. If not, you can qualify for FHA or VA loan after. After Short Sale/Deed-in-Lieu of Foreclosure · Fannie Mae (conventional) loan – 4 years · FHA loan – 3 years · VA loan – 2 years · USDA loan – 3 years. It's vital to keep paying your mortgage until the short sale closes. If you were current, you could qualify for a Federal Housing Administration (FHA) mortgage. If the borrower does not qualify for any of the FHA Home Retention Options and the property sales value is not enough to pay the loan in full, the servicer may. **Short Sales due to relocation and/ or job transfer, that had no late Mortgage Payments prior to date of move may be eligible sooner than 3 yrs (sometimes. If you have experienced a bankruptcy, foreclosure, or short sale, these are the waiting periods before you can obtain a traditional home loan.

Short Sale seasoning to get a new FHA loan can be as little as 1 day after your short sale, if it is executed in a manner, where you had no 30 day mortgage. Mortgage After Short Sale Guidelines: Qualifying for mortgage after short sale is possible after 3 years for FHA Loans and 4 years on conventional loans. We've been in contract since May and man what a process it has been. FHA k loan and currently just waiting for short sale to get approved from sellers end. If you think that a two-year waiting period after a VA short sale is a considerable amount of time, consider this: both FHA and the USDA require a three-year. If you were in default on the old mortgage loan at the time of the short sale, then you usually must wait at least three years before applying for another FHA-. If the borrower does not qualify for any of the FHA Home Retention Options and the property sales value is not enough to pay the loan in full, the servicer may. A 5% down payment is usual with Fannie Mae although they do offer other options with a lower down payment. FHLMC. The Federal Home Loan Mortgage Corporation is. Yes. If you had the bankruptcy 4 years ago or more then you'd qualify for a conventional loan. If not, you can qualify for FHA or VA loan after. The borrower may use the FHA financial incentive towards the repayment of other mortgages and liens. Some rental properties do qualify for the FHA short sale. Borrowers are not eligible for a new FHA mortgage if they pursued a short sale agreement on their principal residence to take advantage of declining market. A 5% down payment is usual with Fannie Mae although they do offer other options with a lower down payment. FHLMC. The Federal Home Loan Mortgage Corporation is. While the VA has no set waiting period following a VA loan short sale, VA loan lenders commonly set a mandatory waiting period of two years before they will. Yes, you can use your VA loan benefit after a short sale, but will likely be required to wait a certain amount of time after the short sale before you are. For an FHA short sale, the bank will want to receive 88% of the sale price, which leaves you with 12% of the sale price for paying all of the other expenses. After Short Sale/Deed-in-Lieu of Foreclosure · Fannie Mae (conventional) loan – 4 years · FHA loan – 3 years · VA loan – 2 years · USDA loan – 3 years. The homeowner may be eligible for an FHA mortgage again if the loan was not in default. There is a 3 year wait if in default at closing of short sale. The. The homeowner may be eligible for an FHA mortgage again if the loan was not in default. There is a 3 year wait if in default at closing of short sale. The. Considering a short sale but have an FHA loan? FHA offers their own short sale program - the FHA PFS Program. Get the scoop! Note: Fannie Mae also will agree to short sales for FHA, VA, or RD mortgage loans if they comply with all of the insurer's or guarantor's guidelines and do not.

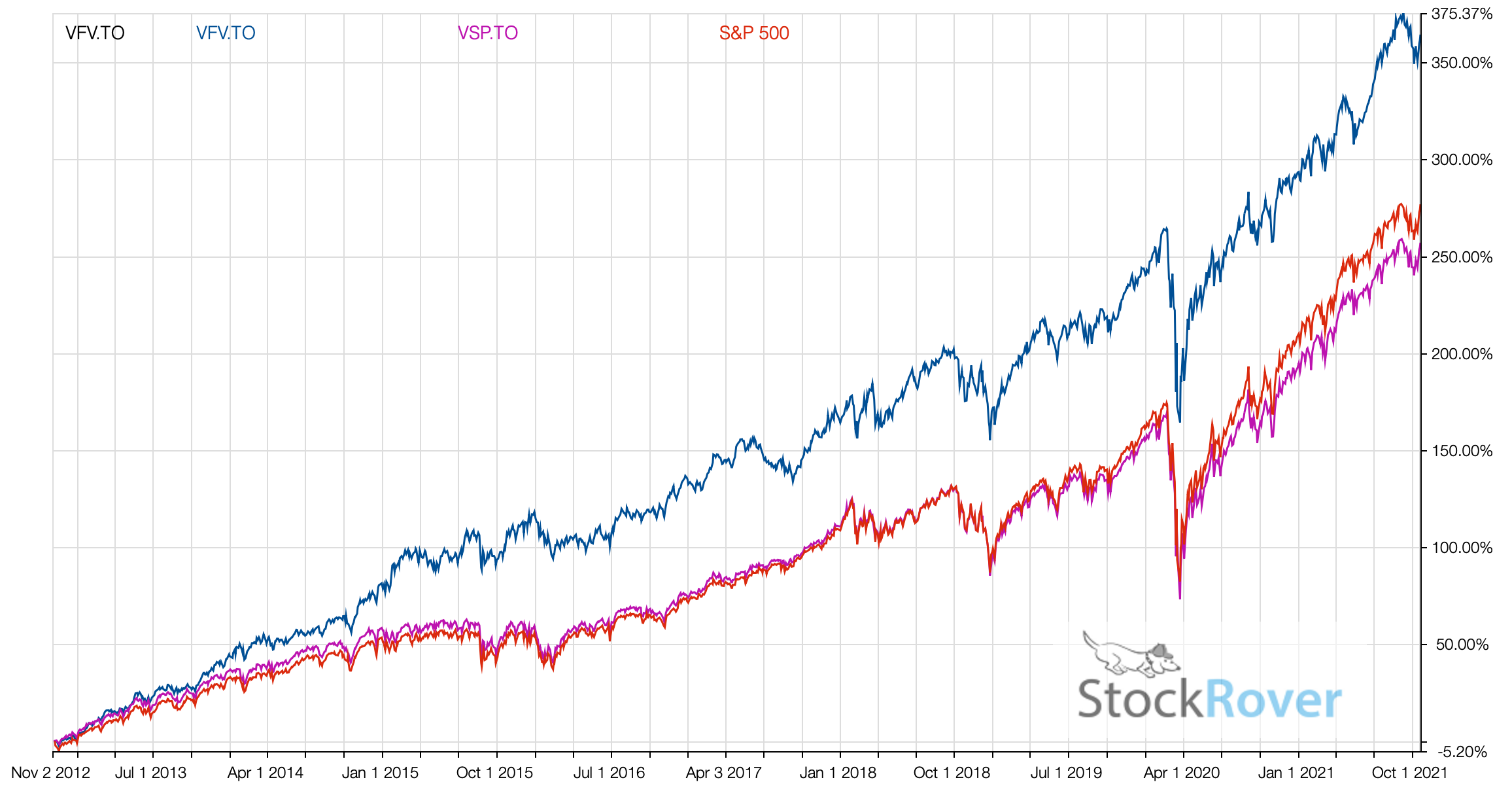

S&P 500 Index Fund Vs Etf

This means the price you pay for shares of an ETF may be more closely aligned with the market it mirrors than those of an index fund. It can give investors more. SPY is the ticker symbol for an exchange-traded fund that tracks the performance of the S&P index; it is traded like a stock. SPX is simply the numerical. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. compared to the index more than 40 years later. Index funds are not S&P Index fund. The Standard & Poor's Composite Index is a market. The major difference between index funds and ETFs is their trading mechanism and flexibility. Index funds can only be bought and sold at the end of the trading. As we've said, a total stock market index fund encompasses a wider universe of stocks than does the S&P , but the difference might not be as great as you. The difference of course is that ETFs are "exchange traded." That means you can buy and sell them intraday, like any other stock. By contrast, you can only buy. Use our ETF and mutual fund comparison tool to view side by side historical performance, risk, expense ratios, and asset class data. An Index fund is simply a fund that tries to track a market index, like an S&P fund for instance. Other funds have other kinds of. This means the price you pay for shares of an ETF may be more closely aligned with the market it mirrors than those of an index fund. It can give investors more. SPY is the ticker symbol for an exchange-traded fund that tracks the performance of the S&P index; it is traded like a stock. SPX is simply the numerical. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. compared to the index more than 40 years later. Index funds are not S&P Index fund. The Standard & Poor's Composite Index is a market. The major difference between index funds and ETFs is their trading mechanism and flexibility. Index funds can only be bought and sold at the end of the trading. As we've said, a total stock market index fund encompasses a wider universe of stocks than does the S&P , but the difference might not be as great as you. The difference of course is that ETFs are "exchange traded." That means you can buy and sell them intraday, like any other stock. By contrast, you can only buy. Use our ETF and mutual fund comparison tool to view side by side historical performance, risk, expense ratios, and asset class data. An Index fund is simply a fund that tries to track a market index, like an S&P fund for instance. Other funds have other kinds of.

Mutual funds are bought and sold directly from the mutual fund company at the current day's closing price, the NAV (Net Asset Value). ETFs are traded throughout. However, ETFs have a tax-efficiency edge over index funds. For example, when an investor wants to redeem shares of an index fund, the index fund manager may. Of course, it's next to impossible for average investors to perfectly replicate the S&P 's exposure by purchasing stock in each of the index's firms. It normally invests at least 80% of its assets in securities within its benchmark index, the S&P ® Index. The Fund buys most, but not necessarily all, of the. The biggest difference is that ETFs can be bought and sold on a stock exchange (just like individual stocks) and index mutual funds cannot. Which Has Higher. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Key takeaways · Exchanged-traded funds (ETFs) are pooled investment vehicles similar to mutual funds. · ETFs track a particular index and can be actively traded. In fact, most index funds are a type of mutual fund. The main The most popular index to track is the Standard and Poor's index (S&P ). The average expense ratio is %. S&P ETFs can be found in the following asset classes: Equity. The largest S&P ETF is the. Now, broadly, the difference between index funds and ETFs lies in the fact that index funds can be bought and sold like any other mutual fund. But for ETFs, you. An index is just a list of companies. So the S&P is a list of large companies. The NASDAQ Composite is a list of companies that trade. The primary difference between ETFs and index funds is how they're bought and sold. ETFs trade on an exchange just like stocks, and you buy or sell them through. ETFs. While they can be actively or passively managed by fund managers, most ETFs are passive investments pegged to the performance of a particular index. An index fund represents a strategy to track the performance of a benchmark, such as the S&P An ETF, on the other hand, is an investment vehicle. ETFs can. Use our ETF and mutual fund comparison tool to view side by side historical performance, risk, expense ratios, and asset class data. A passively managed fund aims to mimic the performance of a specific market benchmark or index — such as the S&P — and is made up exclusively of the. In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange. Investors have enjoyed returns the S&P Index has provided over the years, but it's coming at the cost of concentration risk from overexposure to the. Currently, the S&P index is tracked by 24 ETFs. % p.a. - The largest S&P ETF by fund size in EUR. 1, iShares Core S&P UCITS ETF. ETFs can carry lower management fees than a mutual fund. A Instead, you could gain this broad exposure through an ETF that tracks the S&P Index.

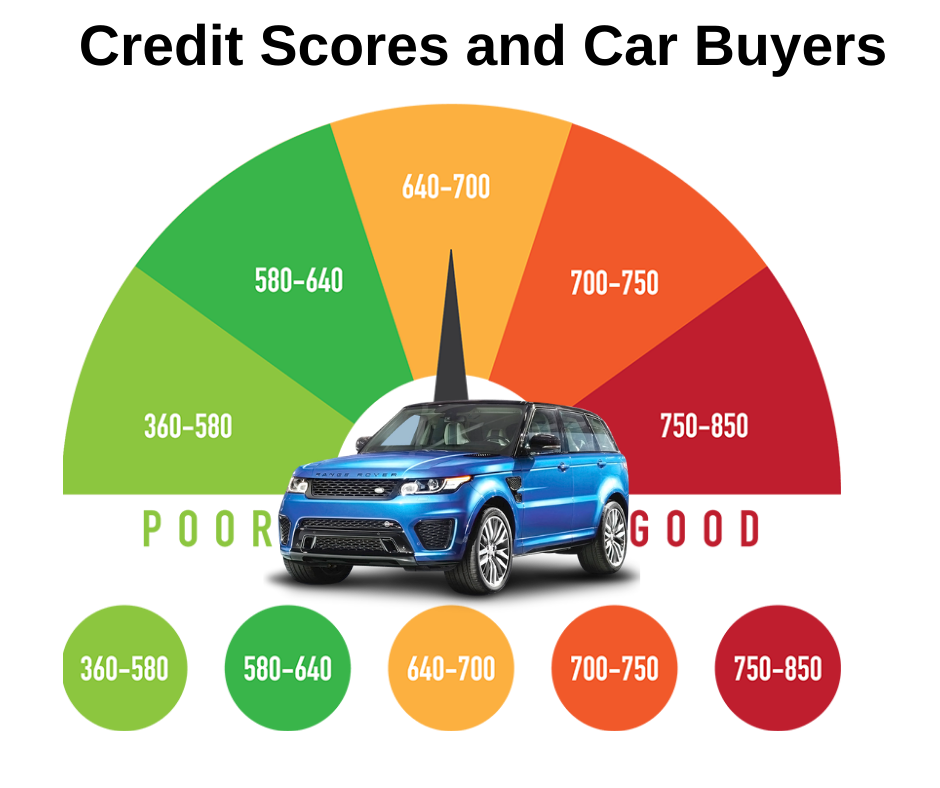

Credit Score Range For Buying A Car

.png)

Credit Score to Finance a Car: What to Expect · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to Yes, new accounts only make up 10% of your FICO Score, but you may see a small drop when you apply for new auto loans. Reviewing your credit reports and score. VantageScore considers a good credit range of around , while a good FICO score range is Dealers may pull from either score, but the FICO. Creditors and lenders consider your credit scores as one factor when deciding whether to approve you for a new account. Your credit scores may also impact the. What credit score is needed to buy a car? A score of or above should get you a car loan at a good interest rate, but borrowers with lower scores have. Subprime lenders specialize in financing credit-challenged car buyers, but they have additional requirements you need to meet in order to get approved. Subprime. While there isn't a set minimum credit score to buy a car, you should aim to have a score of or higher, which puts you in the good credit range. You'll. This is where 25% of borrowers sit when it comes to credit rating, the highest proportion across the different credit score ranges. If your rating comes within. What kind of credit score should I ha e when looking into buying a car? car in that price range you'd want to get. Finance managers can. Credit Score to Finance a Car: What to Expect · Superprime: to · Prime: to · Non-prime: to · Subprime: to · Deep Subprime: to Yes, new accounts only make up 10% of your FICO Score, but you may see a small drop when you apply for new auto loans. Reviewing your credit reports and score. VantageScore considers a good credit range of around , while a good FICO score range is Dealers may pull from either score, but the FICO. Creditors and lenders consider your credit scores as one factor when deciding whether to approve you for a new account. Your credit scores may also impact the. What credit score is needed to buy a car? A score of or above should get you a car loan at a good interest rate, but borrowers with lower scores have. Subprime lenders specialize in financing credit-challenged car buyers, but they have additional requirements you need to meet in order to get approved. Subprime. While there isn't a set minimum credit score to buy a car, you should aim to have a score of or higher, which puts you in the good credit range. You'll. This is where 25% of borrowers sit when it comes to credit rating, the highest proportion across the different credit score ranges. If your rating comes within. What kind of credit score should I ha e when looking into buying a car? car in that price range you'd want to get. Finance managers can.

As a first-time borrower for a car, a good co-signer—one with a good credit score and good credit history—can be huge when purchasing your first car. Here are. We've researched providers of credit score car loans and have identified three that we recommend as our top picks. Conditions and Requirements · Prime: > · Near Prime: · Subprime. If you want to buy a new car with a car loan, your credit score is traditionally a big piece of the puzzle. Dealerships, for instance, will need to check your. But again, there is no minimum credit score for a car loan. Even people with bad credit can get a car loan, which is discussed in the article “How to Get a Car. To get an auto loan without a high interest rate, our research shows you'll want a credit score of or above on the to point scale. That's. To get the best possible rates and monthly payments for the car you want, your credit score should be in the “Good” to “Excellent” range, which is anywhere from. What you really need to understand is that your Auto Score is calculated similarly, but differently than your traditional FICO score. The score range for the. When buying a car, lenders will look closely at your FICO credit score. Your Credit scores can range from to The higher your credit score. A buyer with a FICO score may qualify for $ at 96 months, but a score may be maxed out at $ for 72 months. Move the time and money squares. is a good credit score to buy a car because it proves you are a responsible borrower with a credit history in the prime range. You don't need some magic credit score to get a car loan. Most people and most credit scores — good or poor — can get one. What credit score is needed to buy a car in ? Most traditional auto lenders look for borrowers whose credit score is in the prime range or above ( to. If your credit score is , you're likely to find yourself in the subprime loan range. At Green Light Auto Credit, we're committed to helping those with less-. The length of a car loan can range from one year to more than 85 months. When compared to shorter terms, longer terms may have higher interest rates and lower. There is no minimum credit score to apply for an auto loan, but higher scores typically make you eligible for lower interest rates. You can increase your credit. According to Experian, buyers with credit scores of or higher will qualify for the lowest rates and best terms. Those with scores below may have to pay. Don't worry if your credit score isn't quite that high. The report also noted that 22% of people securing new car leases had credit scores below However. For a used car, the APR will be around 12%. (subprime): With poor credit like this range, you'll likely have to pay high-interest rates. The average APR. Credit Score Needed to Finance a Vehicle · – Superprime · – Prime · – Nonprime · – Subprime · – Deep Subprime.

Cheapest Most Profitable Stocks

Often cheaper means lower market cap, lower profitability(if it's profitable at all), and generally riskier. However, yeah you're right, other. Penny stocks are usually issued by new or very small companies. These companies often don't have a proven track record, which is why their shares are sold for. Best stocks under $20 · Infosys (INFY). · Blue Owl Capital Inc. (OWL). · Permian Resources Corp. (PR). · Vipshop Holdings Ltd. (VIPS). · iQIYI Inc. (IQ). Stocks. Price Data; Index Overview · Daily Activity · Historical Indices · Historical Prices · Near 52 Weeks High - Low. Announcements; Announcements · Board. The best cheap stocks to buy ; Alight (ALIT), $, ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, profit margins. Conversely, they can also fetch prices far above the initial cost, resulting in substantial profits. Benefits of Investing In Penny Stocks. I own PayPal which I consider to still be cheap. Other than that I think Baba is still cheap, but I already own XPEV at a great price. However, buying a diversified portfolio of high-quality companies at reasonable prices is among the most reliable ways to build wealth over the long-term. 7. Stock Movers ; OSTX · OS Therapies ; PSNY · Polestar Automotive ; OKYO · OKYO Pharma ; LFCR · Lifecore Biomedical. Often cheaper means lower market cap, lower profitability(if it's profitable at all), and generally riskier. However, yeah you're right, other. Penny stocks are usually issued by new or very small companies. These companies often don't have a proven track record, which is why their shares are sold for. Best stocks under $20 · Infosys (INFY). · Blue Owl Capital Inc. (OWL). · Permian Resources Corp. (PR). · Vipshop Holdings Ltd. (VIPS). · iQIYI Inc. (IQ). Stocks. Price Data; Index Overview · Daily Activity · Historical Indices · Historical Prices · Near 52 Weeks High - Low. Announcements; Announcements · Board. The best cheap stocks to buy ; Alight (ALIT), $, ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, profit margins. Conversely, they can also fetch prices far above the initial cost, resulting in substantial profits. Benefits of Investing In Penny Stocks. I own PayPal which I consider to still be cheap. Other than that I think Baba is still cheap, but I already own XPEV at a great price. However, buying a diversified portfolio of high-quality companies at reasonable prices is among the most reliable ways to build wealth over the long-term. 7. Stock Movers ; OSTX · OS Therapies ; PSNY · Polestar Automotive ; OKYO · OKYO Pharma ; LFCR · Lifecore Biomedical.

stock market is booming, most Americans are not sharing in the economic recovery. stock repurchases, which helped them “manage” stock prices. The. Best home insurance companies · Cheapest home insurance companies · Home But a more lucrative way might be to scour through the underperforming stocks. Stocks under $5—are officially called “penny stocks” due to their cheap price—are often a high-risk, high-reward proposition. The stocks that sell for under. But these stocks are not investments. Penny stocks are cheap for a reason, and most companies with cheap stock prices are in some kind of trouble. It's. 7 cheap growth stocks to consider in · 1. Zymeworks (ZYME). A biotech company with a strong cash position and promising pipeline assets, offering. Cheap Stocks To Buy And Watch: Silvercorp Busts Through This Trendline Entry · Lichen China (LICN) · CPI Aerostructures (CVU) · Idaho Strategic Resources (IDR). Most Active Options ; Apple (AAPL), ,, iPhones, computers ; Advanced Micro Devices (AMD), 1 million, Semiconductors ; chaspikfest.ru (AMZN), ,, E-commerce. View the most active stocks traded during the day sorted on value as well as volumes. You can see all stocks or view all in a particular index. Top 10 Best Stocks below Rs 10 · 1. Brightcom Group, , , , , , , , , , · 2. Filatex Fash. A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. Penny stock screener. Find the best penny stock companies with strong buy analyst ratings to buy today. Buy for a penny for the chance to leverage big. You can purchase low-price stocks that will leave more cash in your pocket. · A cheap stock is a term that means different things to different people. · For some. Best Penny Stocks Under $ Right Now · #1 - Lucid Diagnostics · #2 - Unicycive Therapeutics · #3 - Aptose Biosciences · #4 - Beyond Air · #5 - Dragonfly Energy · #. Fundamental factors drive stock prices based on a company's earnings and profitability from producing and selling goods and services. Technical factors relate. Oftentimes the “hot penny stock” alerts are on these stocks and primarily benefit those who bought the stocks first. Penny Stocks or Cheap Exchange-Listed. Otherwise click below for more details. ▸ Day Trial. Already a profitable discoveries with investors. This dedication to giving investors a. Most common stocks give shareholders the right to vote on various company In an auction market, the prices of exchange-listed stocks are determined by supply. ADRs are dollar-denominated US securities backed by and related to the underlying company stock - which may for instance, be UK listed shares or. Is the split worth it? – Stock splits have no tangible impact on a company's total value—they simply create more shares at more affordable prices. Nor does a. If you are investing not for dividend and yield but for the income coming from a rise in stock prices, best case scenario is that when AD&D is high, XonMobyll.

Earn Free Crypto Online

Uprock is another way to earn crypto by sharing your unused bandwidth. They are about to go live and will be rewarding early users. To receive your Learn and Earn reward, first you'll read a quick lesson about the crypto token. After completing a lesson, you'll showcase your knowledge by. Earn free crypto rewards while learning about blockchain projects. Learn and earn by watching short Web3 courses and be rewarded now! Welcome to Southeast Asia's favourite Crypto App. No confusing charts, no fancy terms. Just buy, trade and earn crypto rewards. 21+ cryptocurrencies and stablecoins available, with exclusive Private Members' perks. Private Members enjoy an extra 2% pa rewards distributed in CRO. Freecash offers a fast and easy way to earn crypto rewards online by completing various assignments. Required tasks include playing games, trying out. The Learn Crypto blog runs down the ultimate list of ways to earn free crypto, comparing the effort to the reward, and explaining exactly what is needed. 1. Coinbase learning rewards. The easiest way to start generating crypto rewards on Coinbase is through Coinbase Earn. · 2. Stake some of your crypto · 3. Turn. Learn about crypto and get rewards. Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Uprock is another way to earn crypto by sharing your unused bandwidth. They are about to go live and will be rewarding early users. To receive your Learn and Earn reward, first you'll read a quick lesson about the crypto token. After completing a lesson, you'll showcase your knowledge by. Earn free crypto rewards while learning about blockchain projects. Learn and earn by watching short Web3 courses and be rewarded now! Welcome to Southeast Asia's favourite Crypto App. No confusing charts, no fancy terms. Just buy, trade and earn crypto rewards. 21+ cryptocurrencies and stablecoins available, with exclusive Private Members' perks. Private Members enjoy an extra 2% pa rewards distributed in CRO. Freecash offers a fast and easy way to earn crypto rewards online by completing various assignments. Required tasks include playing games, trying out. The Learn Crypto blog runs down the ultimate list of ways to earn free crypto, comparing the effort to the reward, and explaining exactly what is needed. 1. Coinbase learning rewards. The easiest way to start generating crypto rewards on Coinbase is through Coinbase Earn. · 2. Stake some of your crypto · 3. Turn. Learn about crypto and get rewards. Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself.

We offer many offerwalls, faucet, ptc and networks to help you earn money online. It's fast, free and easy! Make money and earn rewards on your phone with. Cointiply does have a free faucet where you can collect Coins each day, but we also have tons of other ways for you to earn WAY more DOGE, Dash, LTC or Bitcoin. chaspikfest.ru; chaspikfest.ru; chaspikfest.ru; chaspikfest.ru; chaspikfest.ru; chaspikfest.ru Naturally, a large number of employers willing. free pretend mining don't waste your bucks join a pool if you can and earn the credit cards over all I do love the game to pass time but crypto idle is the. How to earn crypto rewards · 1. Coinbase learning rewards · 2. Stake some of your crypto · 3. Turn your dollars into stablecoins · 4. Lend some of your crypto with. Crypto Indices · Doodles · Sitemap · Advertise. Company. About us · Terms of use web experience. Because we respect your right to privacy, you can choose not. In this article, the Coingape team has brought you a list of three websites that can help you earn free crypto in just a few steps. Play Bling games to earn free cryptocurrency today! Download our free crypto game BTC Blast, Pop, Solitaire, and more. Win free cryptocurrency just by. Here's what I found and currently use: Brave Browser: you can earn BAT while navigating the web. Besides the rewards, I really appreciate that this browser. Cryptocurrency has opened up numerous opportunities for people to earn digital assets without the need for an initial investment. The Nodle app lets anyone join smart missions and earn cryptocurrencies without needing extra know-how or equipment. Importantly, there's no need to buy. Earn and learn crypto in a fun way. Earn free crypto by watching videos. Get free crypto or trading bonuses while learning about crypto today at Phemex. Use Brave Browser Brave Browser allows users to earn cryptocurrency simply for browsing the web. Users can earn BAT (Basic Attention Token) after viewing ads. KASTA is the native cryptocurrency of chaspikfest.ru One of its popular use cases is yield multiplication. When you lock up KASTA in the app, you can earn up to 8% APY. KASTA is the native cryptocurrency of chaspikfest.ru One of its popular use cases is yield multiplication. When you lock up KASTA in the app, you can earn up to 8% APY. Coinbase Wallet might have the ways to earn for free. Have you looked at Crypto AI or DePin were you can earn for training AI or sharing free. Earn free Bitcoin with instant payouts in StormGain App for IOS and Android or on our website for Mac and Windows. Start in 5 minutes and get your first. Learn & earn crypto easily - start the ultimate play-to-earn game & claim free crypto rewards. Begin your learn & earn crypto journey now! How to Earn Free Crypto? · Learn and Earn Platforms · Crypto Airdrops · Play-To-Earn Games · Cryptocurrency Dividends · Credit Cards · Referral Bonuses · Browser and. Want to earn some crypto without spending a penny? Free crypto giveaway by chaspikfest.ru is an easy way to win Bitcoin, Ethereum, Uniswap, and other virtual.

Ways To Make Money Asap

These 20 money-making ideas could help you bring in extra income and improve your quality of life. Here's how to make money fast. Find random Craigslist jobs for quick ways to make money. Craigslist is a great place to go if you are wanting to learn how to. Online Surveys: Sign up for survey sites like Swagbucks or Survey Junkie. You can complete surveys in minutes and earn cash or gift cards. These 20 money-making ideas could help you bring in extra income and improve your quality of life. You can start earning money with your tech skills without a computer science degree or 15, 5, or even 1 year of experience. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot. Here are seven smart ways to raise money quickly without causing irreparable harm to your finances. This book offers a list of 60 different ideas for making money. There is a wide range of ideas so there is something for everyone. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! No giftcards or discounts, you are paid cash! HOW DOES IT. These 20 money-making ideas could help you bring in extra income and improve your quality of life. Here's how to make money fast. Find random Craigslist jobs for quick ways to make money. Craigslist is a great place to go if you are wanting to learn how to. Online Surveys: Sign up for survey sites like Swagbucks or Survey Junkie. You can complete surveys in minutes and earn cash or gift cards. These 20 money-making ideas could help you bring in extra income and improve your quality of life. You can start earning money with your tech skills without a computer science degree or 15, 5, or even 1 year of experience. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot. Here are seven smart ways to raise money quickly without causing irreparable harm to your finances. This book offers a list of 60 different ideas for making money. There is a wide range of ideas so there is something for everyone. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! No giftcards or discounts, you are paid cash! HOW DOES IT.

Here's how to make money fast. Find random Craigslist jobs for quick ways to make money. Craigslist is a great place to go if you are wanting to learn how to. Here are some ways to help you make money fast in the UK. Whilst not an exhaustive list, these are all sure fire ways to help you make a bit more money quickly. Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Explore areas like content creation. Survey Pop is the fastest, easiest way for making money from your phone. 82% of new members earn $5 sent to their PayPal within the first day of downloading. Paid surveys are among the best methods. They don't need any skills and are free. They are all listed on one website. Visit the Elite Survey. Rent out your spare room — This one is just like AirBnb. If you have a small space then do try out renting it. Why to leave so much money on the. Paid Surveys: Sites like Swagbucks or Survey Junkie pay for completing surveys. · Gig Work: Use platforms like Fiverr to offer quick tasks or. There are plenty of ways to quickly earn cash, whether you're looking to make money in just a single day, online at home, or via a side hustle. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! No giftcards or discounts, you are paid cash! HOW DOES IT. Here are seven smart ways to raise money quickly without causing irreparable harm to your finances. Here are 10 real ways to make money fast: · Sell stuff from around your home. · Find random Craigslist jobs. · Rent out a room in your home. · Answer surveys online. 1. Bookkeeping · Brilliant Bookkeeper. Are you good with numbers? ; 2. Proofreading · proofreading launchpad. Want to make extra money proofreading? ; 3. Run. Get paid to click · Play games, watch videos and earn · Online survey sites · Make money playing games on your phone · Earn hard cash for fun tasks, for example. How to make money fast · 1. Find out if you have unclaimed property · 2. Sell unused gift cards · 3. Trade in old electronics · 4. Take surveys. From selling old textbooks and designing little logos to even taking a paid survey, the internet is full of easy ways to make quick cash. Consulting and Coaching (not requiring certification) can both provide fast paths to cash, if you have skillsets that make that possible. Ebay auctions and. If you're trying to figure out how to make money on the side with quick fix-it jobs or running errands, TaskRabbit might be your best bet. You can do all kinds. You can sell goods and services, recycle or scrap items, do some odd jobs, or borrow money. These methods may or may not be reliable long-term. Completing short tasks or micro jobs online could be the perfect solution if you're looking for quick and easy ways to make money. A variety of websites and. The easiest, fastest, and least-risky way to make money online is typically through freelance work or gig platforms, such as offering services on Upwork or.

What Percent Of Retirement Should Be In Stocks

Although that percentage can vary depending on your income, savings, and debts. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says. Don't stay in cash or cash-like investments – your (k) is a retirement plan that should be invested in things like stocks and bonds with an objective for. The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to minus your age. retirement. It is the riskiest of the 3 models because it invests in the highest percentage of stocks. The chart below represents the different portfolios. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. For example, the 60/40 rule suggests a retiree's portfolio should be 60% equities and 40% fixed-income securities. According to the rule of , another popular. For example, if you're 30, you should keep 70% of your portfolio in stocks. If you're 70, you should keep 30% of your portfolio in stocks. Perspectives on the markets, retirement, and personal finance to help inform your investing journey. should read and consider carefully before investing. T. Average stock allocations by age Young and middle-aged investors keep a relatively high percentage of their portfolio assets in stocks. Investors in their 20s. Although that percentage can vary depending on your income, savings, and debts. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says. Don't stay in cash or cash-like investments – your (k) is a retirement plan that should be invested in things like stocks and bonds with an objective for. The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to minus your age. retirement. It is the riskiest of the 3 models because it invests in the highest percentage of stocks. The chart below represents the different portfolios. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. For example, the 60/40 rule suggests a retiree's portfolio should be 60% equities and 40% fixed-income securities. According to the rule of , another popular. For example, if you're 30, you should keep 70% of your portfolio in stocks. If you're 70, you should keep 30% of your portfolio in stocks. Perspectives on the markets, retirement, and personal finance to help inform your investing journey. should read and consider carefully before investing. T. Average stock allocations by age Young and middle-aged investors keep a relatively high percentage of their portfolio assets in stocks. Investors in their 20s.

An optimal asset allocation is where you have greater than a 70% chance of achieving your financial objectives. My recommended asset allocation should be. The only sensible answer to the question of what percentage of our portfolio that we should have in stocks and bonds in retirement is that this depends on what. So they've allocated 25% of their portfolio to bonds, yet are keeping 5% in REITs and a healthy 45% percentage in equities, a which they anticipate could boost. The makeup of your investment portfolio should change according to your risk tolerance as you approach retirement. While stocks and bonds help with growth. Under this rule, a year-old would invest 90% of their retirement account balance and a year-old would invest 60%. There are also other rules, like the. The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to minus your age. Many of these professionals say that young investors should plan on replacing 80 percent of their income with retirement savings. But, it's crucial that you. At retirement, you should ideally have 25x your annual spending needs in a retirement portfolio. This should last you at least 30 years in. On the other hand, if your goal is very early retirement (also known as financial independence), you likely need to invest heavily in stocks to get the kind of. stocks and bonds may be the starting point for your investments in retirement. One thing most retirement planning specialists agree on is that you should. A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio. Cash and cash equivalents play a variety of. The short answer is that you should aim to save at least 15 percent of your income for retirement and start as soon as you can. But there's more to the. I've read all kinds of suggestions on how much one should have in bonds; For example: your stock percentage should be (or ) minus your age, and the. In general, if you're many years away from retiring, more of your investments should be geared toward those that provide growth opportunities, such as stocks. In that case, a year-old might allocate 80% of their portfolio to stocks ( – 30 = 80), and a year-old might have a portfolio allocation that's 50%. For example, if you are age 40, 60 percent ( minus 40) of your portfolio should consist of stock. For example, if you accept an early retirement package at. While the precise percentages depend on one's personal situation and needs, cash should Otherwise, you might have to sell stocks or other assets at. At the center of the problem is federal pension law, which establishes a 10 percent limit on employer stock in defined benefit plans, but not in defined. Most importantly, your investments should provide funds to sustain you throughout your post-retirement life. retirees to maintain 70 percent in stocks and 47 votes, 95 comments. Vanguard model recommends 90% stock and 10% bond. Is that the right allocation I should follow? I feel I am still.

Best Online Tax Filing For Homeowners

Numerous providers offer reputable tax return software platforms at affordable prices. Some quality options are even free to use. Examples include H&R Block. We cannot accept any claims for Tax Year after this date. Rebates filed online will be issued within 30 days of filing a claim. Paper claims may take. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. Easy to use and a fraction of the cost of the other alternatives. All entities must submit an Annual Report and Personal Property Tax Return every year to remain in good standing and legally operate in Maryland. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way. Access our self-preparation software b File Online. File and Pay Taxes Online · Frequently Asked Questions (FAQs) · Forms and Low and Moderate Income Homeowners Property Tax Relief Program · Doing. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. File taxes online with H&R Block Deluxe. Great for homeowners, gig workers, & investors, we make it easy to eFile taxes and get your max refund, guaranteed. We test and rate the top online tax services to help you find the best one for filing quickly and accurately—and for getting the largest possible refund. Numerous providers offer reputable tax return software platforms at affordable prices. Some quality options are even free to use. Examples include H&R Block. We cannot accept any claims for Tax Year after this date. Rebates filed online will be issued within 30 days of filing a claim. Paper claims may take. FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and H&R Block. Easy to use and a fraction of the cost of the other alternatives. All entities must submit an Annual Report and Personal Property Tax Return every year to remain in good standing and legally operate in Maryland. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way. Access our self-preparation software b File Online. File and Pay Taxes Online · Frequently Asked Questions (FAQs) · Forms and Low and Moderate Income Homeowners Property Tax Relief Program · Doing. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. File taxes online with H&R Block Deluxe. Great for homeowners, gig workers, & investors, we make it easy to eFile taxes and get your max refund, guaranteed. We test and rate the top online tax services to help you find the best one for filing quickly and accurately—and for getting the largest possible refund.

Homeowners' Property Tax Credit Application HTC-1 Form ○ Filing Deadline October 1, Apply Online for Faster, Easier Filing & Status Updates: http. Best Tax Prep Software. The best products and services. Our experts did the A woman on a computer at home filing taxes. What is an IRS form? A. Home. Forms & Filing. Forms & Instructions · Individual Income Tax Filing · Estates, Trusts, and the Deceased · Sales and Use Tax · Employer Withholding. We can do Federal and Minnesota returns, including property tax refunds for renters and homeowners. Schedule your tax clinic appointment now! Fall tax. Known for its network of more than 5, offices around the U.S., Jackson Hewitt offers online tax filing for $25, including fees for as many states as needed. Some people have used online tax preparation software for years. When would be the best time to consider hiring an accountant? What are a few items people tend. The Office of Tax and Revenue (OTR) Homestead Unit has implemented the electronic online filing of the ASD Homestead Deduction, Disabled Senior Citizen, and. filing method that best fits your needs. No matter what company you select, you can always return to file your Maryland tax return for free online, using. The Internal Revenue Service (IRS) administers the Volunteer Income Tax Assistance (VITA) Program to provide free basic tax return preparation for low- and. TurboTax Premium Online makes it easy to file your taxes for self-employment and rental property income, stocks, bonds, ESPPs, crypto, and other investments. “H&R Block provides an exceptionally easy-to-use product to prepare returns for both federal and state taxes. I felt very comfortable that the returns I. filing your federal taxes using tax return preparation software or through a tax professional. Electronic Federal Tax Payment System: Best option for businesses. online appointment. Schedule an Eligibility and amounts for cash-back tax credits depend on your income, household size, filing status and residency. best deductions and exclusions in your tax returns. We'll review all of your tax documents and provide you with an efficient filing process. Experts-Icon. About 70% of taxpayers qualify for a free federal tax return via the IRS Free File program. If you have an adjusted gross income (AGI) of $79, or less, you. It's not too good to be true. See what others are saying about filing taxes online with com. Try it for yourself. MyFreeTaxes is an easy online tool that helps you file your taxes for free. The site offers free step-by-step guidance to filing taxes as well as help through. Filing Options. Home» Taxation» Individual» Tax Types» Property Tax Credit» Filing Options If you are unsure which form best meets your filing needs, use. Filing Taxes · The best products and services · Best Tax Software · Best Tax Software for Small Business · File Your Taxes for Free · faq · Expert reviews · Popular. Join the 30 million Americans who already have saved money by using IRS Free File, the free way to electronically prepare and e-file your federal tax return.

Investopedia Retirement

The Investopedia Retirement Guide will help you get started, stay on track, catch up, and make smart investment decisions along the way. Please note that this. Describe Your Retirement Goals What's your investment style? The projections and other information you will see here about the likelihood of various. Choosing the right investments is only one piece of the retirement planning puzzle. Here are six tips to keep in mind as you save and invest for retirement. 2 Investopedia: “Do You Need Life Insurance After You Retire?” by Tim Parker, December 3, chaspikfest.ru Learn how much you need to retire comfortably, and how to prepare for the "unexpected." Plan for everything from living expenses, to healthcare. stocks, bonds, and cash investments. These funds are designed to make investing for retirement more convenient by automatically changing your investment mix. Regardless of whether you're 25 or 55, saving for retirement is a wise financial strategy. Everyone will face retirement at some point, either by choice or. With our investment calculator, you can find out how much you can expect to have in your retirement portfolio over time. Retirement planning is tricky. If you plan to retire within 10 years, now's the time to cross these tasks off your retirement checklist. The Investopedia Retirement Guide will help you get started, stay on track, catch up, and make smart investment decisions along the way. Please note that this. Describe Your Retirement Goals What's your investment style? The projections and other information you will see here about the likelihood of various. Choosing the right investments is only one piece of the retirement planning puzzle. Here are six tips to keep in mind as you save and invest for retirement. 2 Investopedia: “Do You Need Life Insurance After You Retire?” by Tim Parker, December 3, chaspikfest.ru Learn how much you need to retire comfortably, and how to prepare for the "unexpected." Plan for everything from living expenses, to healthcare. stocks, bonds, and cash investments. These funds are designed to make investing for retirement more convenient by automatically changing your investment mix. Regardless of whether you're 25 or 55, saving for retirement is a wise financial strategy. Everyone will face retirement at some point, either by choice or. With our investment calculator, you can find out how much you can expect to have in your retirement portfolio over time. Retirement planning is tricky. If you plan to retire within 10 years, now's the time to cross these tasks off your retirement checklist.

A retirement income plan can help you define your withdrawal strategy—or when and how often you will pull money from your retirement investment accounts. Your employer will determine if your retirement plan's investment selection for PCRA includes only mutual funds or most available investments. You decide. The Fidelity Non-Prototype Retirement Account (also called Investment-Only) is a brokerage account for businesses that want a wide range of investment. Here are 5 retirement planning steps to take: chaspikfest.ruopedia. com/articles/retirement/11/5-steps-to-retirement- chaspikfest.ru 손종창. Retirement Planning Tips in Your Mids and Beyond. Follow these retirement planning tips—whether or not you're retired. By. The Investopedia Team. Some financial planning experts believe you need to save enough so that your retirement income is in the range of 70% to 80% of your pre-retirement income. The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it. Fidelity Investments offers Financial Planning and Advice, Retirement Plans, Wealth Management Services, Trading and Brokerage services, and a wide range of. Betterment helps you manage your money through cash management, guided investing, and retirement planning. Investopedia on March 29, It was. For example, a plan investment doesn't have to be a “winner” if it was part of a prudent overall diversified investment portfolio for the plan. Since a. Some people prefer a self-directed IRA because it gives them more investment options. That's not a bad decision, provided you don't risk your savings by. Depending on your goals and plans for retirement, $ million is enough to withdraw $60, per year for 25 years. A key one of these is amending the Employee Retirement Income Security Act (ERISA) to provide a safe harbor for plan fiduciaries investing participant assets in. retirement portfolio allocated to cash or bonds. Your returns won't be high Investopedia is part of the Dotdash Meredith publishing family. By. Investment Professional Background Check · EDGAR - Search Company Filings · Fund Analyzer · Retirement Ballpark E$timate · Social Security Retirement Estimator. Key Takeaways · Financial Independence, Retire Early (FIRE) is a financial movement defined by frugality, extreme savings, and investment. · FIRE proponents may. The world is always changing, so why do most retirement accounts still look like it's ? Our Automated Investing Account helps you build retirement wealth by. Explore retirement savings accounts from Navy Federal In as little as 10 minutes, you could be investing with Digital Investor's automated or self-directed. Key Takeaways · Social Security benefits are not guaranteed, and you may find greater financial comfort having a personal retirement account instead of relying. A target date fund is an age-based retirement investment that helps you take more risk when you're young and gets more conservative over time. Discover how.