chaspikfest.ru Gainers & Losers

Gainers & Losers

Newest Crypto To Buy

Evaluate how much commission you provide to your crypto exchange when you buy and sell crypto. A new crypto investor will want a platform that is easy. Discover the top trending cryptocurrencies on CoinGecko. This list is sorted by coins that are most searched for in the last 3 hours. While Bitcoin is the most popular cryptocurrency, top cryptocurrencies by market cap include Ethereum, BNB, Litecoin, XRP, Dogecoin, among others. Cryptocurrency values surged above $60,, reaching its highest point since Enthusiasts are waiting to see if it can achieve a new record high during. Bring blockchain to the people. Solana supports experiences for power users, new consumers, and everyone in between. Stay alert to the crypto gems newly listed on KuCoin. Make informed decisions by checking the price charts, market cap, trading volumes. There are many websites that you can look over to find new cryptocurrencies. Some of the more reputable ones are Top ICO List and Smith & Crown. If you lose dinner's on me, if you won you have to buy me a coffee!! Whether you are a seasoned investor or new to the crypto space, PhilToken offers. If you do choose to purchase digital currencies or tokens, recognize that they are new. There may be significant risk involved in putting your money into. Evaluate how much commission you provide to your crypto exchange when you buy and sell crypto. A new crypto investor will want a platform that is easy. Discover the top trending cryptocurrencies on CoinGecko. This list is sorted by coins that are most searched for in the last 3 hours. While Bitcoin is the most popular cryptocurrency, top cryptocurrencies by market cap include Ethereum, BNB, Litecoin, XRP, Dogecoin, among others. Cryptocurrency values surged above $60,, reaching its highest point since Enthusiasts are waiting to see if it can achieve a new record high during. Bring blockchain to the people. Solana supports experiences for power users, new consumers, and everyone in between. Stay alert to the crypto gems newly listed on KuCoin. Make informed decisions by checking the price charts, market cap, trading volumes. There are many websites that you can look over to find new cryptocurrencies. Some of the more reputable ones are Top ICO List and Smith & Crown. If you lose dinner's on me, if you won you have to buy me a coffee!! Whether you are a seasoned investor or new to the crypto space, PhilToken offers. If you do choose to purchase digital currencies or tokens, recognize that they are new. There may be significant risk involved in putting your money into.

We list brand new ERC and other crypto tokens, coins, DeFi tokens, and more. Buy Bitcoin Trade Now Futures. CoinMarketCap: Like CoinGecko, CoinMarketCap is an alternative that some investors use to find new crypto coins. It provides a list of ICOs and relevant. Best Crypto to Buy Now – Top 10 Crypto to Invest In. Michael Graw. seconds ago · 16 Best New Meme Coins to Buy in Alan. Buy, hold, and sell popular cryptocurrencies and stablecoins such as BTC, ETH, DOGE, SHIB, AVAX, LTC, UNI, ETC, LINK, XLM, AAVE, the list goes on. Cryptocurrencies may be today's shiny, new opportunity but there are serious risks involved. Proceed with caution, do your research, evaluate your financial. chaspikfest.ru is trusted by million+ users worldwide. Trade safely and securely with industry-leading compliance and security certifications today. One way to acquire new cryptocurrencies before they are listed on major exchanges is to participate in initial coin offerings (ICO), initial exchange offerings. New Cryptocurrencies ; 3 · $, % ; 4 · $, %. Top 3 Presale News ; 1. OPZ: The World's First AI Powered Wallet & DEX ; 2. Base Chain: What is it? And why is it so popular? ; 3. Solana: The New Home for Meme. Bitcoin (BTC) · Ethereum (ETH) · Binance Coin (BNB) · Solana (SOL) · Ripple (XRP) · Dogecoin (DOGE) · Polkadot (DOT) · SHIBA INU (SHIB). When I try to add new purchased crypto to my page, it says I don't hv any chaspikfest.ru - Buy Bitcoin & Crypto. Finance. What measures are in place, or what thought has been given to possibly investing in crypto as a new asset class? The pilot can begin with the purchase of some. chaspikfest.ru is trusted by million+ users worldwide. Trade safely and securely with industry-leading compliance and security certifications today. Pepe Unchained – Ethereum Layer-Two Chain Features the Popular Pepe Meme. Key Points. A blend of the iconic Pepe and cutting-edge Layer 2 blockchain. Stay alert to the crypto gems newly listed on KuCoin. Make informed decisions by checking the price charts, market cap, trading volumes. The best place to buy, sell, and pay with crypto #BTC #CRO #DeFi #FFTB. Cryptocurrencies. Choose from + digital currencies, including majors, alt-coins, emerging tokens, and stablecoins. Designed with accessible sizing, enjoy the all new secure touchscreen user experience to manage crypto and NFTs. When you buy crypto like Bitcoin and Ethereum. Discover new crypto coins & tokens that have been recently listed and new cryptocurrencies released today ; 1. APPLE Token. APPLE. APPLE Token. - ; 2. X-GAME. XG. Newest Projects Launched Last Month ; Wormhole Bridged USDC (Fantom) · Aug. 23, ; Logo Core Blockchain. Core Blockchain · Aug. 22, ; Logo Core Token.

Close Ended Investment Company

Closed-end funds hold professionally managed portfolios of stocks, bonds, or other securities. They are registered with the Securities and Exchange Commission. Closed-End Fund. Our closed-end fund benefits from global investment research that addresses the demands of the ever-changing financial landscape. We understand. What is a closed-end fund? A closed-end fund holds an IPO at launch and the money raised from that IPO is used by portfolio managers to buy securities. A closed-ended investment fund has a fixed number of units that can be issued subject to company law or the investment fund's own constitution. Units are. What is a closed-end fund? A closed-end fund holds an IPO at launch and the money raised from that IPO is used by portfolio managers to buy securities. Closed-end funds issue a fixed number of shares that are traded on the stock exchanges or in the over-the-counter (OTC) market. BlackRock closed-end funds provide several advantages to producing more income with less risk. Learn why these investment strategies are right for you. Total closed-end fund (CEF) assets were $ billion at year-end Traditional CEFs had total assets of $ billion, interval funds had total assets of $ A closed-end fund invests the money raised in its initial public offering in stocks, bonds, money market instruments and/or other securities. Here. Closed-end funds hold professionally managed portfolios of stocks, bonds, or other securities. They are registered with the Securities and Exchange Commission. Closed-End Fund. Our closed-end fund benefits from global investment research that addresses the demands of the ever-changing financial landscape. We understand. What is a closed-end fund? A closed-end fund holds an IPO at launch and the money raised from that IPO is used by portfolio managers to buy securities. A closed-ended investment fund has a fixed number of units that can be issued subject to company law or the investment fund's own constitution. Units are. What is a closed-end fund? A closed-end fund holds an IPO at launch and the money raised from that IPO is used by portfolio managers to buy securities. Closed-end funds issue a fixed number of shares that are traded on the stock exchanges or in the over-the-counter (OTC) market. BlackRock closed-end funds provide several advantages to producing more income with less risk. Learn why these investment strategies are right for you. Total closed-end fund (CEF) assets were $ billion at year-end Traditional CEFs had total assets of $ billion, interval funds had total assets of $ A closed-end fund invests the money raised in its initial public offering in stocks, bonds, money market instruments and/or other securities. Here.

Closed-end funds are investment vehicles with a fixed number of shares during an IPO, unlike ETFs & mutual funds, which offer additional shares to meet. All closed-end funds (CEFs) were structured as perpetual funds, meaning they have no “maturity” or termination date. A closed-end fund refers to an investment vehicle that issues a fixed number of shares. All shares are created at the Initial Public Offering. A closed-end fund raises capital for investment through a one-time sale of a limited number of shares, which may then be traded on the markets. A closed-end fund has a fixed number of shares offered by an investment company through an initial public offering. Open-end funds do not have a fixed. A closed-end management company is an investment company that manages closed-end mutual funds and sells a limited number of shares to investors on an exchange. An open-ended fund may offer a lower level of risk overall as the price of shares represents the capital growth and income generated on the portfolio of assets. This report provides basic identification information for all entities with an "active" filing status that are organized as closed-end investment companies. NYSE Closed-end Management Investment Company. Corporate Governance Affirmation. Issuer: Symbol: Type of Affirmation: Initial. 1. Annual. Notice of Non. Unlike mutual funds, closed-end funds are not subject to sales charges (loads). Instead, transactions are subject to commissions. Also, closed-end funds can be. Closed-end funds (“CEFs”) can play an important role in a diversified portfolio as they may offer investors the potential for generating capital growth and. What are closed-end funds? A closed-end fund is one of three main types of investment companies that the Securities and Exchange Commission regulates. Nuveen's latest closed-end fund update provides an in-depth look at trends and offers detailed commentary and analysis for key closed-end fund segments within. Closed-end funds (CEFs) are professionally managed investment companies that offer investors an array of potential benefits. an entity: (b) whose primary object is investing and managing its assets (including pooled funds contributed by holders of its listed securities). This Investor Bulletin discusses closed-end funds whose shares can be bought and sold on national securities exchanges, or “publicly traded” closed-end funds. Closed-end funds and unit investment trusts are unique investments and involve special risks. They may not be suitable for all clients. Characteristics of. Closed-end funds raise money through an initial public offering (IPO) by offering a fixed number of shares at an offering price. A closed-end investment company is a type of investment that allows an investor to buy into several stocks/bonds in one transaction without all of the trading. “Closed” structure allows for greater flexibility in the types of investment strategies that can be used and helps portfolio managers stay invested for the.

Consumer Reports Tens Unit

Customer reviews for CVS Health Advanced TENS Targeted Muscle Therapy. Go to ratings & reviews Great Tens Unit and doesn't cost an arm and a leg. myTwoCents • 2y ago. Tens unit - $ - selected for good reviews on Amazon Thank you SO much for such a detailed comprehensive review. Overall, the TENS is an excellent investment for anyone looking for a non-invasive, drug-free way to manage pain. It's durable, effective, and incredibly. TENS machine delivers a small electrical current to the body through electrodes attached to the skin. TENS, is a form of pain relief without medicine. Links to the best tens unit consumer reports listed in this review video: ▻ 1. TENS Digital TENS Unit Muscle Stimulator. More recently, many TENS units use a mixed frequency mode which alleviates tolerance to repeated use. Intensity of stimulation should be strong but comfortable. Want to find out which Home Remedies for Back Pain are actually worth a try? Consumer Reports explains what really works, what to skip, and what might make. This spontaneous case was reported by a consumer (subsequently medically confirmed) and describes the occurrence of burn infection ("i got a burn on my back. TENS Unit for effective pain relief are available at chaspikfest.ru, your trusted source for advanced pain management solutions. Explore top-rated TENS. Customer reviews for CVS Health Advanced TENS Targeted Muscle Therapy. Go to ratings & reviews Great Tens Unit and doesn't cost an arm and a leg. myTwoCents • 2y ago. Tens unit - $ - selected for good reviews on Amazon Thank you SO much for such a detailed comprehensive review. Overall, the TENS is an excellent investment for anyone looking for a non-invasive, drug-free way to manage pain. It's durable, effective, and incredibly. TENS machine delivers a small electrical current to the body through electrodes attached to the skin. TENS, is a form of pain relief without medicine. Links to the best tens unit consumer reports listed in this review video: ▻ 1. TENS Digital TENS Unit Muscle Stimulator. More recently, many TENS units use a mixed frequency mode which alleviates tolerance to repeated use. Intensity of stimulation should be strong but comfortable. Want to find out which Home Remedies for Back Pain are actually worth a try? Consumer Reports explains what really works, what to skip, and what might make. This spontaneous case was reported by a consumer (subsequently medically confirmed) and describes the occurrence of burn infection ("i got a burn on my back. TENS Unit for effective pain relief are available at chaspikfest.ru, your trusted source for advanced pain management solutions. Explore top-rated TENS.

Copper Life TENS Therapy Device This thing is great. Easy to use and helps my muscle pain very much. I was very skeptical but Tens worked the very 1st time. Many brands offer transcutaneous electrical nerve stimulation (TENS). An independent Web-based consumer news and resource center, providing recall information and tens of thousands of pages of consumer reviews. Physical therapy is becoming more accessible with many insurances now allowing telehealth, even for Medicare. A TENS unit can be helpful to manage pain. Pharmacists ranked the best TENS unit brands for home use and purchased without a prescription. Omron is their No.1 brand. Overall, the TENS is an excellent investment for anyone looking for a non-invasive, drug-free way to manage pain. It's durable, effective, and incredibly. There are several uses of the TENS unit. It alleviates pain and reduces muscle spasms caused by arthritis, knee pain, and sports injuries. It also helps with. Some people use a transcutaneous electrical nerve stimulation (TENS) unit to treat pain. This device works by sending electrical impulses through the skin. TENS Elite Rechargeable TENS Unit Muscle Stimulator and Pain Relief Machine · Trusted by Starting Strongman Body Builder Kalle Beck · Place Your Trust in the. Patient reported that device did not respond to lowering or shutting off and it responded with an electric chaspikfest.ru this context, considering the mechanism of. Pocket Pain Pro® TENS Unit · Long Life Pads™ - Large. Model: PMLLPAD-L (). out of 5 stars. reviews. LEARN MORE · Long Life Pads™- Standard. Model. What a difference using this new Wireless TENS! I love the snap-on Pads. Quick and easy. And its strong current already helped the pain in my legs, back, neck. Consider factors like intensity levels, portability, and ease of use. Popular brands with positive reviews include [insert popular brands here]. I like this device. I like the ease of using the app to change settings and time. The TENS pulses do what they're supposed to and there are so many levels. There is nothing complicated enough inside a TENS unit to make it worth more than about $60USD. Actually the less bells and whistles, the better. Read these verified TENS units reviews from customers who have tried the product and see what other pain-sufferers like you are saying about this safe. Best TENS unit comparison guide ; Balego TENS Dual Channel Stimulator, 9v battery, $, 40, Y ; iReliev TENS Unit, 3 AAA batteries, $, 8, Y. HiDow Wireless Device · 2 Wireless Receivers · 1 Lower Back Electrode Gel Pad & 1 Set of Large Electrode Gel Pads · X-Wires · AC Adapter · USB Charging Cable. A chiropractor's TENS unit review and recommendations for back pain relief reviews or recommendations. I hope you find my recommendations useful. Buy TENS online and view local Walgreens inventory. Free shipping at $ Find TENS coupons, promotions and product reviews on chaspikfest.ru

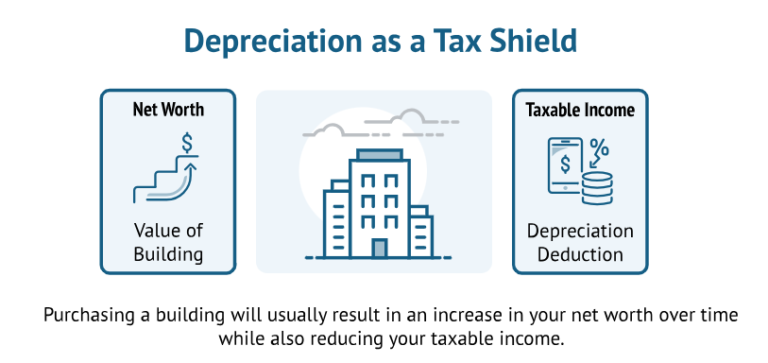

Business Expenses Reduce Taxable Income

First, a deduction is claimed against income to reduce income; a credit is claimed against tax payable to reduce tax liability. So, the small business deduction. At tax time, your total profit (the amount you need to pay tax on) is your income minus the expenses you can claim — so the more you can claim, the less tax you. Note: We have discontinued Publication , Business Expenses; the last revision was for Below is a mapping to the major resources for each topic. Unreimbursed business expenses reportable on PA Schedule UE. Miscellaneous deductions. No provision. Deductions Allowed For Pennsylvania Tax Purposes. 1. If it's been a down year, consider deferring expenses and accelerating income · 2. Make gifts to your family · 3. Understand the tax implications of your. The IRS does provide tax deductions for small businesses to decrease their taxable income, recognizing that business expenses should not be taxed as profit. When you travel for business purposes, direct business expenses are fully tax deductible. This includes flights, hotels, meals, and transportation. Every. To help reduce your tax bill, you can offset many of your business expenses against your business income. You'll need to keep good records and hold on to your. Ordinary and necessary costs you incur in running your business can be deducted from your income, which reduces the amount of tax that you will owe. First, a deduction is claimed against income to reduce income; a credit is claimed against tax payable to reduce tax liability. So, the small business deduction. At tax time, your total profit (the amount you need to pay tax on) is your income minus the expenses you can claim — so the more you can claim, the less tax you. Note: We have discontinued Publication , Business Expenses; the last revision was for Below is a mapping to the major resources for each topic. Unreimbursed business expenses reportable on PA Schedule UE. Miscellaneous deductions. No provision. Deductions Allowed For Pennsylvania Tax Purposes. 1. If it's been a down year, consider deferring expenses and accelerating income · 2. Make gifts to your family · 3. Understand the tax implications of your. The IRS does provide tax deductions for small businesses to decrease their taxable income, recognizing that business expenses should not be taxed as profit. When you travel for business purposes, direct business expenses are fully tax deductible. This includes flights, hotels, meals, and transportation. Every. To help reduce your tax bill, you can offset many of your business expenses against your business income. You'll need to keep good records and hold on to your. Ordinary and necessary costs you incur in running your business can be deducted from your income, which reduces the amount of tax that you will owe.

Businesses are unique in that they can deduct their expenses to decrease their taxable income. Most individuals can only deduct very specific expenses. A personal, living, or family expense is not deductible unless the Internal Revenue Code specifically provides otherwise. Tax deductions for individuals fall. Taxpayers located in the state may take a credit for personal property tax paid. The amount of the credit can be up to 50% of the taxpayer's business tax. This is when you deduct the cost of a business expense in partial amounts over a period of 15 years. Self-Employment Tax. As an LLC member, you'll need to pay. The key is to deduct only the expenses that are directly related to your business. For example, you could deduct the internet-related costs of running a website. You may be able to claim a home office deduction for the portion of your rent that is directly related to your home office and reduce your taxable income. But. A tax deduction is a business expense you claim to reduce the amount of tax you pay. These business expenses are deducted from your gross income to reduce your. In fact, one of the most common ways for companies to reduce their taxes is to deduct certain expenses from their income. Companies can reduce their tax burden. The limitation under MACRS for any taxable year shall be reduced (but not below zero) by the amount by which the cost of IRC section qualifying property. income that may reduce your tax liability. Standard Deduction If you claimed the standard deduction on your federal income tax return, you must also claim. Expenses such as office rent, utilities, maintenance, etc. are tax deductible for corporations. These costs can represent a significant portion of your. More In Forms and Instructions · 1. Deducting Business Expenses. Tax Guide for Small Business · 2. Employees' Pay. Tax Guide for Small Business · 3. Rent Expense. Sole proprietors, partners, and corporations can reduce the amount of tax they pay by deducting allowable business expenses from their income before. The limitation under MACRS for any taxable year shall be reduced (but not below zero) by the amount by which the cost of IRC section qualifying property. This means that employees can no longer reduce their taxable income by deducting employee business expenses (as listed below) or job search expenses. Overall. Tax deductions are a way to reduce your taxable income and, consequently, your tax bill expenses, reduce a self-employed person's overall professional income. A corporate tax deduction refers to an expense that is subtracted from a company's taxable income, thereby reducing the amount they will owe in taxes. The Maryland earned income tax credit (EITC) will either reduce or eliminate the amount of the state and local income tax that you owe. Detailed EITC guidance. Small business tax deductions are expenses related to your business that can be written off on your taxes. These tax deductions lower your taxable income. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage.

How To Put Money In Atm Card

You can get cash, deposit cash and checks, make transfers between accounts, check account balances and make a payment to your Bank of America credit card. Insert your checks and bills without an envelope. Cash deposits are credited to your account instantly. Simply put your money in, confirm your deposit and be on. The short answer: Yes, it's possible. However, not all ATMs accept cash, and some of those that do charge fees. So if you want to deposit cash at an ATM. Simply stack the cash and checks you want to deposit and insert into the ATM when prompted; Confirm your deposit and that's it! Check out our short video to see. He gives us the cash and I put the money into his account from our account. Is it possible to send money to an atm to withdraw remotely? To easily withdraw from or deposit cash to your checking account, you can use your debit card at an ATM. The first thing you need to do is insert your debit. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. Generate a secure. You can get those for cash at the Post Office or WalMart. Fees apply, getting a free checking account from a local credit union would be better. Insert your card and enter your PIN. · Choose the “Deposit” option. · Select which account you'd like the money to go to (usually savings or checking). · Type in. You can get cash, deposit cash and checks, make transfers between accounts, check account balances and make a payment to your Bank of America credit card. Insert your checks and bills without an envelope. Cash deposits are credited to your account instantly. Simply put your money in, confirm your deposit and be on. The short answer: Yes, it's possible. However, not all ATMs accept cash, and some of those that do charge fees. So if you want to deposit cash at an ATM. Simply stack the cash and checks you want to deposit and insert into the ATM when prompted; Confirm your deposit and that's it! Check out our short video to see. He gives us the cash and I put the money into his account from our account. Is it possible to send money to an atm to withdraw remotely? To easily withdraw from or deposit cash to your checking account, you can use your debit card at an ATM. The first thing you need to do is insert your debit. Just hand the cashier your cash, they'll swipe your card, and your money will load automatically. Retail service fee of up to $ applies. Generate a secure. You can get those for cash at the Post Office or WalMart. Fees apply, getting a free checking account from a local credit union would be better. Insert your card and enter your PIN. · Choose the “Deposit” option. · Select which account you'd like the money to go to (usually savings or checking). · Type in.

Bring your debit card and cash to a participating merchant like Walmart, CVS, 7-Eleven, Walgreens. Step 2. Tell the clerk you'd like to load cash ($20 minimum). Insert your cash and checks² right into the ATM. No deposit slips or envelopes needed! STEP. 2. Review your. The ATM will prompt you to continue your transaction, so you can deposit additional cash and/or checks. Q. Do I need to sort my cash before depositing it? A. No. How to deposit cash at an ATM · Insert your debit card to access your account. Once you insert your bank card into the ATM, you'll likely be prompted to enter. Zelle®: To send money in minutes with Zelle®, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking. How do I deposit money at an ATM? · Endorse all checks by signing the back with a pen · Insert your debit card into the appropriate ATM slot and type in your PIN. If you're in need of cash, you can use both a debit card and a credit card to withdraw money at ATMs. "If you have credit card debt, then putting. You just swipe the card and enter your PIN number on a key pad. Debit cards take money out of your checking account immediately. Debit cards let you get cash. Most debit cards also can be used to withdraw cash at ATMs (automated teller machines). Why do people use debit cards? For many people, it is more convenient to. Choose “Check Deposit” or “Cash Deposit”. Insert checks (endorse the back of each check) or cash accordingly. Some ATMs accept 10 checks at a time and all ATMs. Insert your atm card, enter your pin number, this will bring up tge menu: deposit cash, withdraw cash, check balance etc. Click on deposit cash. Simply stack the cash and checks you want to deposit and insert into the ATM when prompted; Confirm your deposit and that's it! Check out our short video to see. Depositing cash in atm with a card · Put your debit card in and your PIN. · Choose "Deposit." · Insert the cash after entering the desired deposit amount. · Verify. Insert your ATM / debit card. If using an ATM card, remove it. If using a debit card, leave it in the ATM for the entire transaction. Enter your PIN. Choose. At most ATMs, you can simply tap your card or phone to begin your transaction. At our other ATMs, if inserting your card, receiving your card before your cash. Use a debit card. load & unload up to $1, for up to $ · Use a barcode from your digital account. Chime, Cash App, PayPal, One & more options available. You can get those for cash at the Post Office or WalMart. Fees apply, getting a free checking account from a local credit union would be better. Bring your debit card and cash to a participating merchant like Walmart, CVS, 7-Eleven, Walgreens. Step 2. Tell the clerk you'd like to load cash ($20 minimum). We continue to expand the number of ATMs that accept deposits for your 24/7 convenience. A client getting money out of the ATM. HOW TO FIND AN OLD NATIONAL. When making a deposit, simply insert cash or checks and the ATM does the rest. The ATM scans your checks, counts your bills, and totals them on screen. You.

How To Get A Diversified Portfolio

Diversification is essentially a risk management strategy that enables portfolios to ride out the natural fluctuations that impact all asset classes — and get. You can diversify your portfolio by owning funds across different asset classes that include stocks, bonds, real estate, commodities, and cash. Then diversify. One of the quickest ways to build a diversified portfolio is to invest in several stocks. A good rule of thumb is to own at least 25 different companies. By diversifying, you spread your money between different investment types to reduce the overall impact of risk when investing. Spreading your investments. What Is Diversification? · 5 Ways To Help Diversify Your Portfolio · 1. Spread the Wealth · 2. Consider Index or Bond Funds · 3. Keep Building Your Portfolio · 4. To get started building a diversified portfolio, identify five sectors from the image above that you are interested in. The easiest way to diversify is to hold funds invested in a range of stocks and bonds. If you have a brokerage account, you can buy fully diversified, low-cost. By investing in more than one asset category, you'll reduce the risk that you'll lose money and your portfolio's overall investment returns will have a smoother. Diversification is an investment strategy that lowers your portfolio's risk and helps you get more stable returns. Diversification is essentially a risk management strategy that enables portfolios to ride out the natural fluctuations that impact all asset classes — and get. You can diversify your portfolio by owning funds across different asset classes that include stocks, bonds, real estate, commodities, and cash. Then diversify. One of the quickest ways to build a diversified portfolio is to invest in several stocks. A good rule of thumb is to own at least 25 different companies. By diversifying, you spread your money between different investment types to reduce the overall impact of risk when investing. Spreading your investments. What Is Diversification? · 5 Ways To Help Diversify Your Portfolio · 1. Spread the Wealth · 2. Consider Index or Bond Funds · 3. Keep Building Your Portfolio · 4. To get started building a diversified portfolio, identify five sectors from the image above that you are interested in. The easiest way to diversify is to hold funds invested in a range of stocks and bonds. If you have a brokerage account, you can buy fully diversified, low-cost. By investing in more than one asset category, you'll reduce the risk that you'll lose money and your portfolio's overall investment returns will have a smoother. Diversification is an investment strategy that lowers your portfolio's risk and helps you get more stable returns.

A diversified portfolio is one in which your investments are spread across various asset classes with varying degrees of risk and potential for growth. How To Diversify Portfolio Investments · Qualitative risk analysis: This strategy assigns a pre-defined rating to an investment's success, usually to stocks and. Another way to achieve diversification is by spreading your investments across multiple industries and sectors. This means allocating your funds across several. Some of the most common ways to diversify a portfolio include diversifying in different asset classes, within each asset class, and in different markets around. A diversified portfolio should include a mix of asset classes, diversification within asset classes, and adding foreign assets to your investment strategy. To build a diversified portfolio, you should look for investments—stocks, bonds, cash, or others—whose returns haven't historically moved in the same direction. Diversification helps mitigate the risk to you about such scenarios by choosing different investments and types of investments. Diversification doesn't. By spreading your investments across different assets, you're less likely to have your portfolio wiped out due to one negative event impacting that single. What you choose to invest in may be largely led by how hands-on you want to be. The ultimate in simple one-step diversification would be to pick an index fund. Usually expressed on a percentage basis, your asset allocation is what portion of your total portfolio you'll invest in different asset classes, like stocks. Portfolio diversification is the process of spreading your investments across different asset classes, such as stocks, bonds, or real estate. How to build a diversified portfolio · The basics. Before you can begin constructing your portfolio, you need to think about your goals and attitude to. Portfolio diversification works the same way. Investors first diversify at a very high level by using different asset classes (equity, fixed income and. How to Diversify Your Portfolio. You should have some of all of the following: stocks, bonds, real estate funds, international securities, and cash. Why Is It. Portfolio diversification is an investment strategy that spreads investments out through various asset classes, sectors, and geographies to reduce risk &. How to diversify portfolio investments · Stocks and Bonds: Start by investing in a combination of stocks and bonds. · Different Sectors: Spread your investments. By diversifying, you spread your money between different investment types to reduce the overall impact of risk when investing. Spreading your investments. A well-diversified portfolio can help ensure that your assets are invested appropriately for your financial goals. A diversified portfolio is one in which your investments are spread across various asset classes with varying degrees of risk and potential for growth. Another way to achieve diversification is by spreading your investments across multiple industries and sectors. This means allocating your funds across several.

1099 Income

INT reports interest income typically of $10 or more from your bank, credit union or other financial institution. The form reports the interest income you. We issue Form MISC on or before January 31 each year (or the following business day if January 31 falls on a weekend or legal holiday). Non-U.S. publishers. Form is a collection of forms used to report payments that typically aren't from an employer. forms can report different types of incomes. NetSuite provides customized saved searches to help you report –MISC vendor payments to other providers, such as Yearli by Greatland, Sovos, and Track MISC, INT and NEC Reporting FAQs: 1. What should I do if I do not agree with the amounts reported on my Form ? There are 2 income tax deductions that reduce your taxes. First, your net earnings from self-employment are reduced by half the amount of your total Social. The Business Income & Receipts Tax (BIRT) is based on both gross receipts and net income. Both parts must be filed. This is a completely separate tax from the. You'll need to file Form SS Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. You might also need to file a. The form is a common IRS form covering several potentially taxable income situations. Depending on what's happened in your financial life during the. INT reports interest income typically of $10 or more from your bank, credit union or other financial institution. The form reports the interest income you. We issue Form MISC on or before January 31 each year (or the following business day if January 31 falls on a weekend or legal holiday). Non-U.S. publishers. Form is a collection of forms used to report payments that typically aren't from an employer. forms can report different types of incomes. NetSuite provides customized saved searches to help you report –MISC vendor payments to other providers, such as Yearli by Greatland, Sovos, and Track MISC, INT and NEC Reporting FAQs: 1. What should I do if I do not agree with the amounts reported on my Form ? There are 2 income tax deductions that reduce your taxes. First, your net earnings from self-employment are reduced by half the amount of your total Social. The Business Income & Receipts Tax (BIRT) is based on both gross receipts and net income. Both parts must be filed. This is a completely separate tax from the. You'll need to file Form SS Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. You might also need to file a. The form is a common IRS form covering several potentially taxable income situations. Depending on what's happened in your financial life during the.

Use our AI powered taxes calculator to know how much to set aside for employee taxes based on your self employed income tax and tax. A tax calculator takes into account your income, expenses, and deductions to determine your tax liability. NEC instead. Previously, companies reported this income information on Form MISC. The Internal Revenue Service introduced the new independent. The W2-G is considered a Other Income Statement. Submit non-wage statements (s) only if Georgia tax is withheld. Statements that do not indicate. Do I need to register and pay state taxes? · You are required to collect sales tax. · Your gross income equals $12, or more per year. · You are required to. According to the IRS, gross income is defined as all facets of income an individual has received throughout the calendar year. An error occurred. Try. Form NEC, Nonemployee Compensation To calculate their quarterly taxes, independent contractors must estimate their adjusted gross income, taxable income. Form MISC reports payments made to others in the course of your trade or business, not including those made to employees or for nonemployee compensation. The MISC is a tax information form generally used to report any payments made to a service provider or contractor. This helps the IRS track how much they. Explanation of some of the boxes on Form MISC: Box 1: Report rents from real estate on Schedule E. If you provided significant services to the tenant. Reporting your form is simple on the eFile Tax App; read below to see what kinds of income you may receive a for and how to file taxes with this tax. If you received a Form NEC with wages that should've been reported on a W-2, enter your NEC as instructed. We'll ask you question. What does it mean to have income? A tax form is a record for Form MISC, Miscellaneous Income; Form NEC, Nonemployee Compensation. What is form Misc? Yale University will issue a form MISC annually to report non-employee compensation (Post Doc Fellowships (PDF). A Form MISC is sent to individuals who receive at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest and/or to. Treasury's Income Record Form Remittance Guide outlines required forms, due dates, and acceptable filing methods for state copies of W-2s and s. Nominee/middleman returns. Generally, if you receive a Form for amounts that actually belong to another person, you are considered a nominee recipient. You. Form NEC and MISC. While there are many types of Form , they all serve to report non-employment income to the IRS. A taxpayer usually reports MISC income on Form , Line 21, as “other income” on their tax return. This is for reporting income such as prizes, rents.